What sets one digital wallet apart from another and what are the key features you should look for before starting to store your personal data? Here, we discuss the three that we find the most important and explain why.

By Sam Curren

Between Apple Pay, Cash App, Google Pay and others, the number of digital wallets has exploded in recent years, with Capital One reporting there were roughly 3.4 billion users worldwide in 2022. As more consumers familiarize themselves with wallet apps, using them for moving money or purchasing goods or services has become commonplace.

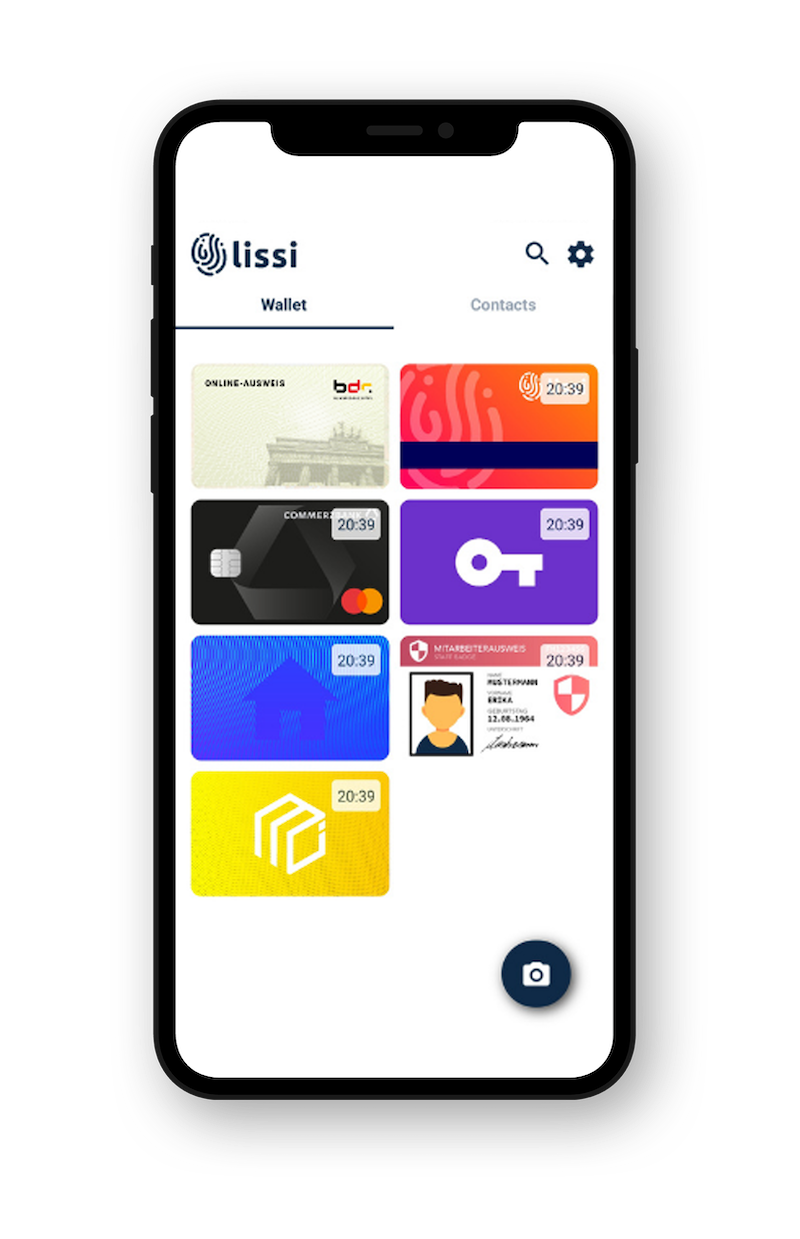

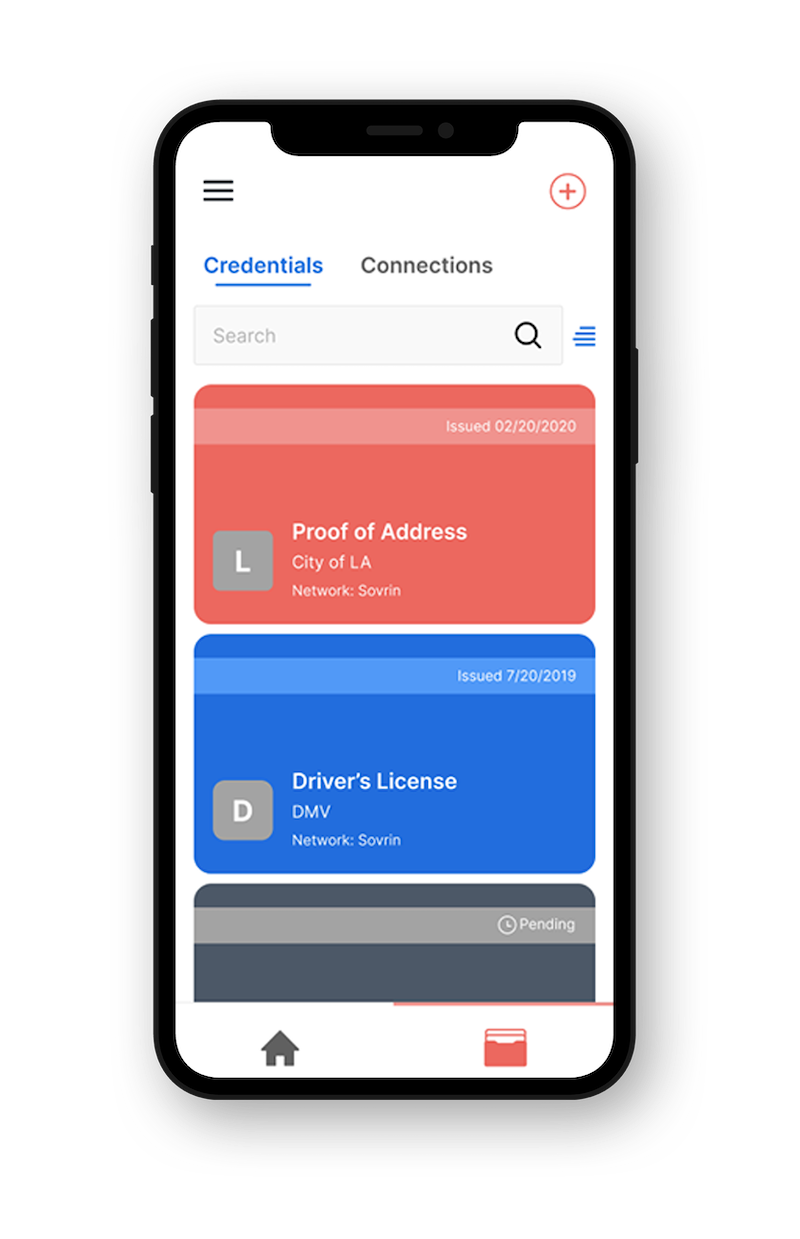

If identity verification is to emulate the convenience of digital payments, the wallets we use need to offer more functionality than just the ability to accept, hold, and present a verifiable credential, they need to have the tools to fully manage your digital identity and data sharing.

The first additional feature to look for in a digital identity wallet is process management. Sometimes the process for being issued with a verifiable credential is simple: you fill out a few forms from the issuing party, which are confirmed by the issuing party, and then you are issued with a credential. For example, when applying for a mobile driver’s license there are several attribute fields to fill out, such as name, height, weight, eye color, etc. These allow the Department of Motor Vehicles (DMV) to confirm that you are the correct person to issue the license to.

But what if the DMV decides it needs more information? Does the wallet notify you? Does the DMV have a procedure in place to notify you? Often services like this simply don’t have the time or processes in place to inform you of the need for more information, and the onus is on you to follow up. By having process management built into the wallet it would be able to easily notify you that the process is stalled and explain why.

The second feature to look for is the ability to act as a verifier and be able to read credentials. Every identity wallet by default is designed to hold credentials and create presentations of the information they contain; this allows you to share your mobile driver’s license or a proof of your age. But before you share this information, it would be ideal to be able to verify for yourself who you’re sharing this information with. For example, if you were pulled over by someone dressed as a police officer, this functionality could confirm that they actually are a police officer, and even provide you with important information such as their jurisdiction, name, and badge number. Similarly, this function would also allow two people to simply verify each other, for example when meeting someone for the first time: if a person comes to your door claiming to be from the gas company you could verify their credentials before letting them in to your house, and they could verify that you are the correct customer they are supposed to be helping, providing an additional layer of security and confidence.

The third feature we recommend is the ability to offer mutually authenticated two-way messaging. This allows you to cryptographically validate the identity of who you are interacting with (and they, you), and is a powerful way to deter fraud. (To learn more about how this works, read our recent article.)

But besides stopping fraud, this feature also changes the way businesses and individuals can interact: instead of getting a letter or email from your bank, it can ping you to ask questions or start a conversation. Unlike email, this is a direct, encrypted communication that you know is coming from your bank. You can also easily sever this connection, and while you probably don’t want to do this with your bank, you may want to remove the ability for other parties to contact you.

In sum, we see identity wallets as building the foundation for digital relationships and these features provide powerful ways to build trusted digital relationships that are more richly interactive.

***

Indicio offers a free-to-use wallet, Holdr+, which you can download right now to see some of these features in action, such as secure, mutually authenticated communication. Future versions of Holdr+ will have all the functionality outlined above.

If you are looking to create your own custom wallet solution or have questions for our team about using Holdr+ for your organization, we encourage you to get in touch. We’re happy to help.