From managing deepfakes to creating reusable KYC, decentralized identity’s ability to easily implement verifiable identity and data without direct integration provides a powerful path for improved efficiency, better fraud protection, and a new level of personalized account service and data privacy.

By Tim Spring

Over the next few weeks Indicio will look at how decentralized identity and verifiable credential technology can transform banking and finance. The unique way this technology handles authentication — such as the identity of an account holder — is a powerful solution to the challenges of identity fraud, while also being a better way to manage customer experience (no more passwords, no need for multi-factor authentication).

But it doesn’t stop there — we can authoritatively know who we are talking to online, and verify the integrity of their data, leading to seamless operational processes and providing a starting point for creating better products and services.

Here’s a taste of what we’ll be looking at.

Re-use costly KYC

To open a checking account at most banks, you need to provide government-issued identification with your photo, your Social Security card or Taxpayer Identification Number, and proof of your address. Gathering this information can be difficult, time consuming, and frustrating. KYC can take anywhere from 24 hours to three weeks, and costs the average bank $60 million per year.

How many times should you need to do this? Once, with a verifiable credential. And once you’ve done it the information can easily be shared both internally and with partners, resulting in smoother workflows and more opportunities for customers.

Fraud

In 2023, 145,206 cases of bank fraud were reported in the US alone. But the headline loss of money isn’t the only problem here: For every $1 lost to fraud, $4.36 is lost in related expenses, such as legal fees and recovery. This means that the estimated $1.6 billion lost to fraudulent payments in 2022 cost almost $7 billion.

Decentralized identity provides a better way to tackle this — and it doesn’t require banks to embark on a massive new IAM system.

Phishing

Phishing happens when you think the email or SMS message you just received is from your bank and you absolutely must login to the link provided or face disaster. It works. 22% of all data breaches involve phishing.

We’ll explain how verifiable credentials provide a way for you to always know — and know for certain — that you are talking to your bank and, if you are the bank, that you’re talking to a real customer.

Frictionless processes keep customers coming back

44% of consumers face medium to high friction when engaging with their digital banking platform. This means that almost half of people trying to access online banking have a hard time, and with friction being attributed as the cause for 70% of abandoned digital journeys, customers are very likely to give up and leave if they face frustration.

We’ll explain how verifiable credentials save customers (and you) from the costs of friction.

Passwordless Login

No one likes passwords. They are the universal pain point of digital experience. And that pain can be costly: 30% of users have experienced a data breach due to weak passwords. Verifiable credentials make all this go away and enable seamless, passwordless login. Imagine, never having to remember or recreate a password again or follow up with multi factor authentication.

We’ll also look at improving financial inclusion and crystal ball the near future — simplified payments, countering buyback fraud and verifiable credentials for credit cards.

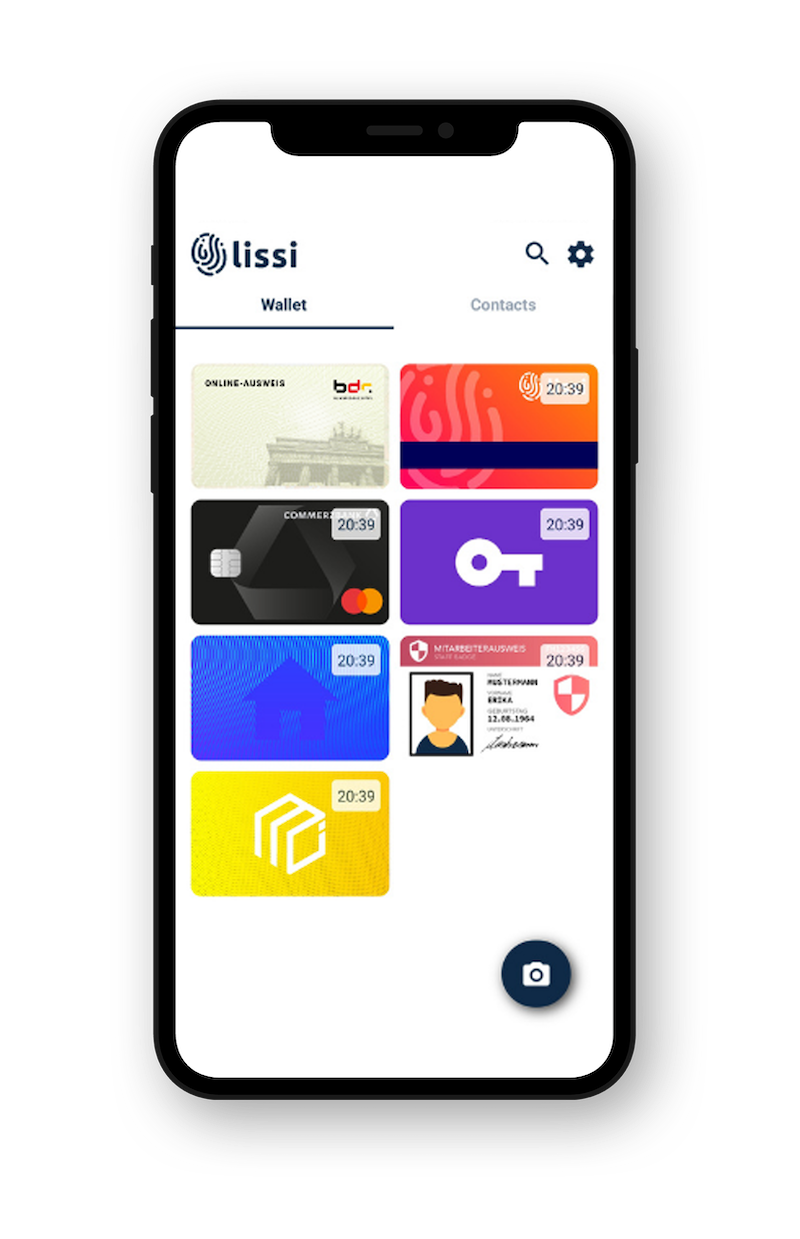

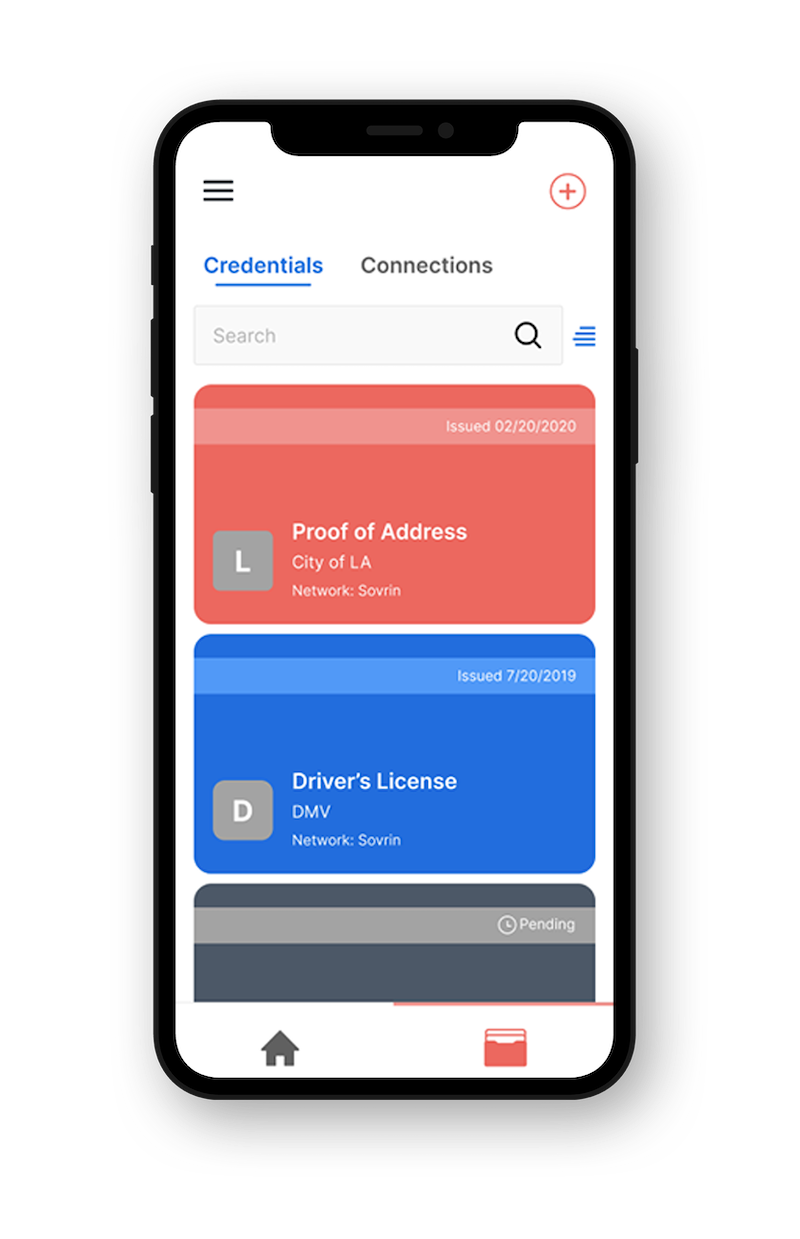

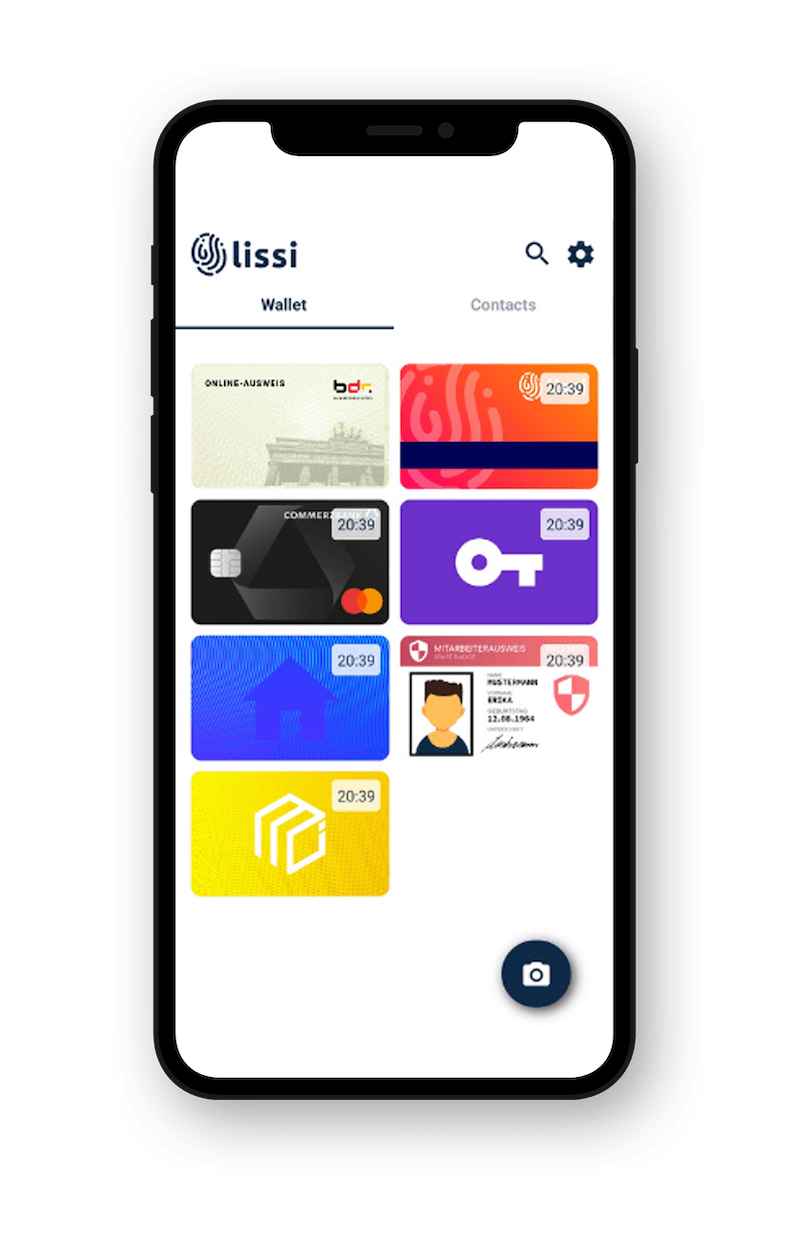

For those not familiar with verifiable credentials, it might help to prepare with our Beginner’s Guide to Decentralized Identity or watch one of our demonstrations.

And, of course, if you have questions or would like to discuss specific use cases or issues your organization is facing please get in touch with our team.

####