Our regular look at the stories making news from around the decentralized identity community. In this edition, we look at the increasing focus on open banking and the benefits for both consumers and financial institutions.

By Tim Spring

The Future Of Financial Services: Developing Your Open Banking Strategy

Alexander Radchenko, Chief Executive Officer at Intellectsoft, writes in Forbes on why financial institutions need to pay attention to open banking. How does open banking differ from regular banking? Open banking uses technology, such as APIs, to offer nonfinancial and financial businesses a network of financial products like accounts and transaction methods. This means third-party providers are allowed access to payment products so they can design and build new user experiences. In 2018, the European Union introduced thePayment Services Directive (PSD2), legislation which “required banks to put the power back into the hands of customers by requiring banks to open up access to their data to third parties.” These third parties can provide a range of services, from managing the financial needs of small businesses to helping people budget.

Radchenko notes that open banking’s ability to speed up payments is critical to current businesses. Today’s customer does not have the time or patience for lengthy processes, and points to statistics such as “Half of Americans agree they’re less likely to buy something online if the entire checkout process takes longer than half a minute.”

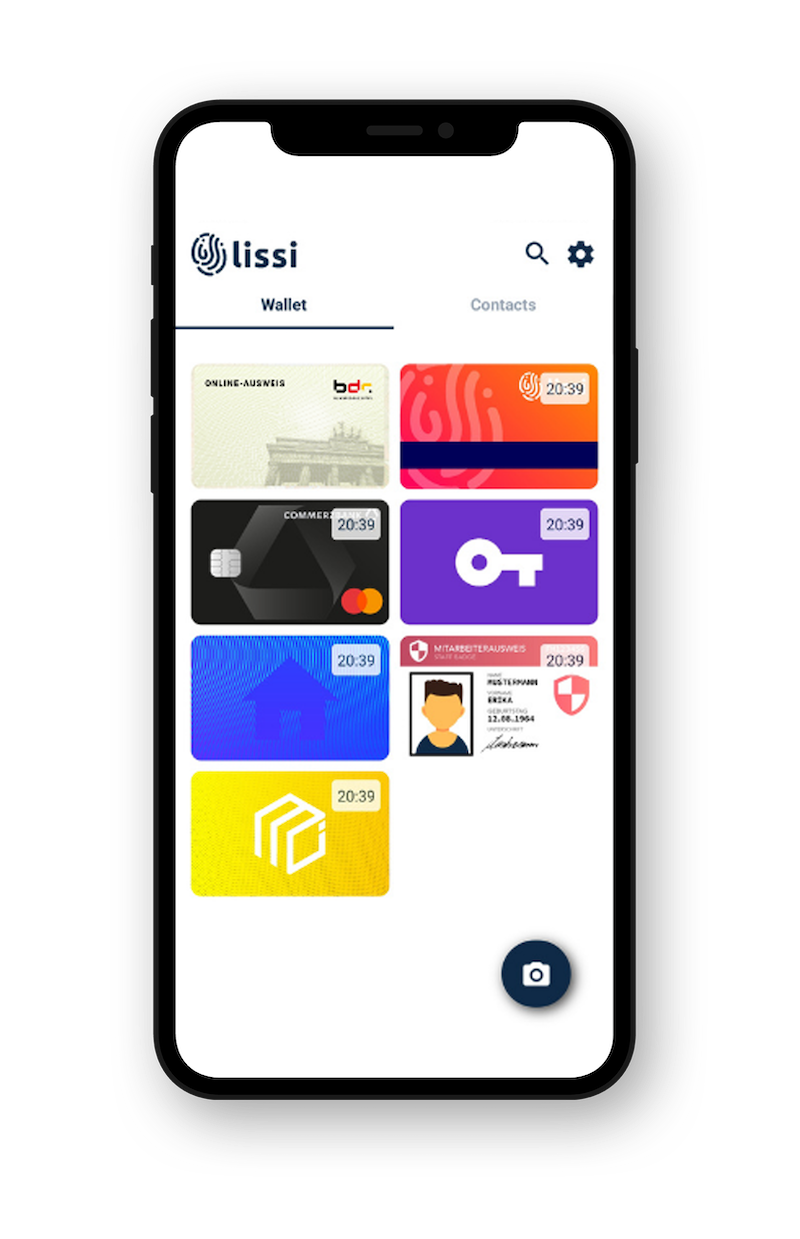

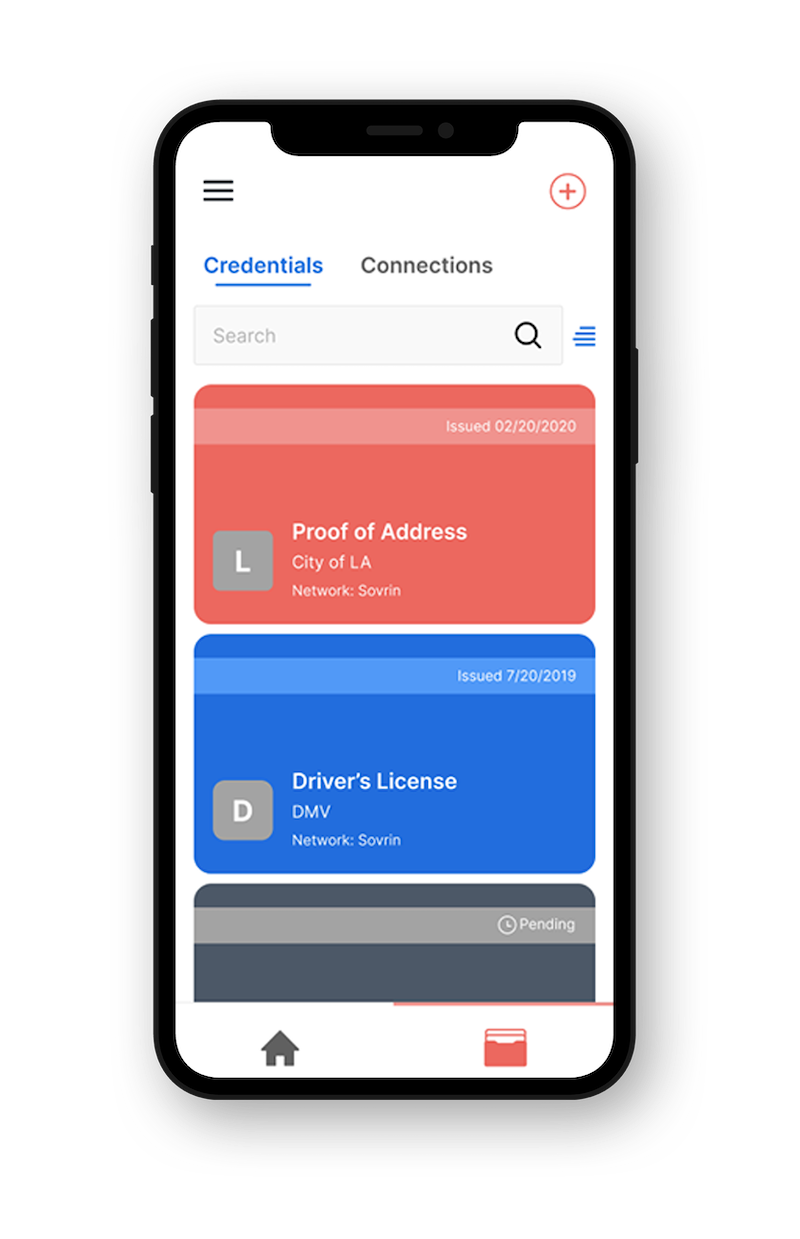

The key to open banking is to be able to create and sustain trusted connections between your bank and third parties that need to access your data. But creating these trusted relationships can be more complex than most people think. Having a third-party service directly access financial data through an API raises non-trivial privacy and security issues for consumers. This is why open banking needs verifiable credentials to flourish—as we explain in our recent article about consent-based data sharing with Indicio Proven Finance.

Driving Financial Inclusion for Small Businesses in Jordan with Open Banking

Dylan Thiam, Head of Marketing & Content at TESOBE / Open Bank Project, explains how open banking has exploded in Jordan. At the end of November the Central Bank of Jordan published legislation requiring all banks to “open Account Information and Payment Initiation services to authorized third-party providers by the end of 2023.”

One of open banking’s key value propositions is that it can deliver critical business services to small and medium-sized businesses (SMEs) which are otherwise unavailable from large banks.

For example, in Jordan, only 10% of all bank and microfinance institution (MFI) loans go to MSMEs due to either their lack of documentation and credit history or banks being unable to handle smaller loans and financing. Given that SMEs make up 96% of the corporate economy in Jordan, the impact of these new rules on the economy will likely be significant.

The Consumer Financial Protection Bureau Open Banking Rule

The Consumer Financial Protection Bureau (CFPB) is a US Government agency tasked with making sure consumers are treated fairly by banks, lenders, and other financial institutions. Recently, the CFPB unveiled its Open Banking Rule, which would push the financial services industry toward open banking and require financial institutions to provide six categories of customer information, including customer identity information (address, name, etc) and transaction information to authorized third parties.

The motivation behind the ruling is, according to CFPB Director Rohit Chopra, to boost market competition in the financial sector by “empowering people to break up with banks that provide bad service.” By enabling the consumer to have control over their data, Chopra says that consumers can more easily take their business anywhere, and to smaller or newer organizations that would have otherwise been unable to compete with larger banks.

Nigeria Greenlights Open Banking to Deepen Financial Inclusion, Boost Innovation

Nigeria has become the first African country to adopt open banking regulations. While traditional banking usage is low in Nigeria, the use of mobile money — apps that allow you to send money to peers, make purchases, apply for loans and pay bills, all from money stored in a bank-style account linked to their mobile phone. — is very popular.

This raises interesting use cases, as the end users here don’t necessarily care about traditional “banking” at all, but instead seek better integration between mobile money networks and financial institutions. Every integration enables more access for everyone to their financial institutions and apps of choice, enabling more people that previously couldn’t to benefit and be a part of the local economy.

Learn how Indicio supports open banking with Proven Finance

We designed Indicio Proven Finance to deliver seamless verification and data sharing while providing the privacy and security needed to assure customers that their data is safe. Learn how it works and watch a demonstration here.

If you want to learn more about how Indicio can help your organization to adopt open banking technologies you can read the Proven Finance web page, or for specific questions you can contact our team of experts.